Agent Cost Optimization Is the New Cloud Cost Optimization. Here's Why It Matters.

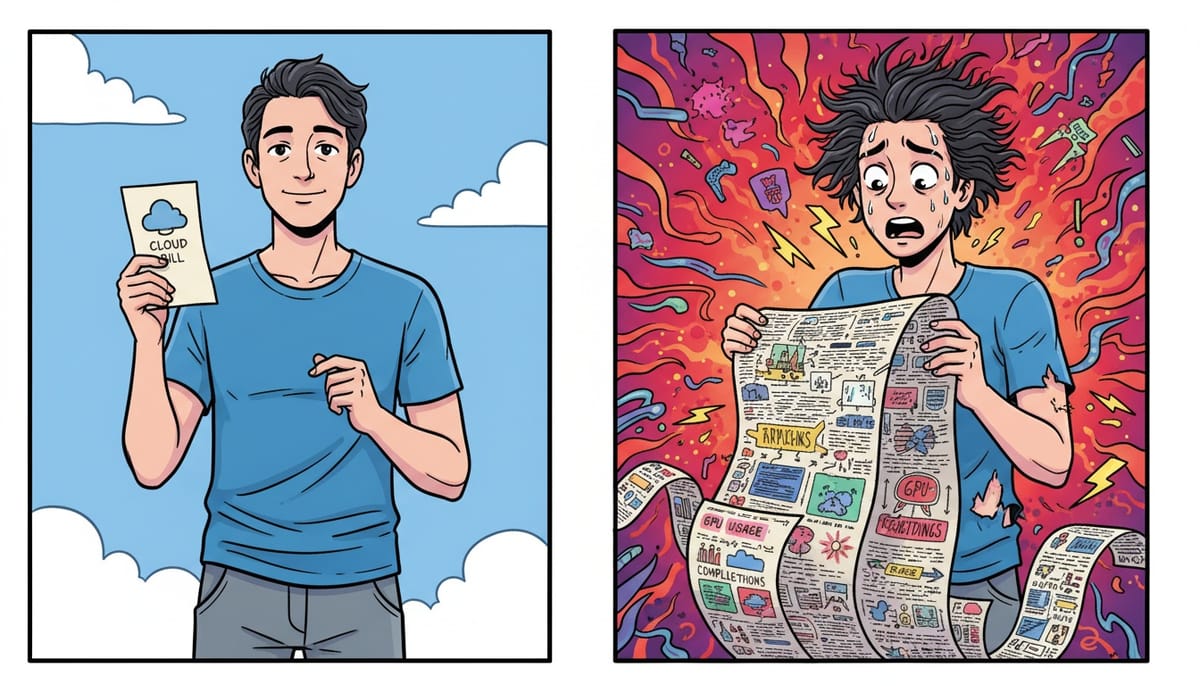

Remember when your AWS bill first hit four figures and everyone panicked? That scramble to understand why a forgotten EC2 instance was burning $200/month? The frantic Slack threads about which team spun up that massive RDS cluster?

That was 2018. Companies eventually figured it out. FinOps became a discipline. Cloud cost optimization turned into a career path. Today, most engineering teams have dashboards, alerts, and budgets for their infrastructure spend.

Now the same chaos is happening with AI agents. Except this time, it's worse.

The Agent Cost Problem Is Different

Cloud costs were relatively predictable. Spin up a server, pay by the hour. Storage costs per gigabyte. Bandwidth per transfer. The units were clear even if the totals surprised you.

Agent costs are fundamentally messier. You're paying per token, but token counts vary wildly based on:

- How verbose your prompts are

- How much context you're stuffing into each request

- Whether your agent decides to loop three times or thirty

- The unpredictable nature of multi-step reasoning

One customer query might cost $0.02. Another might cost $2.00. Same agent, same task type, wildly different economics.

A recent industry analysis found that 46% of organizations cite integration challenges as their primary barrier to agent adoption. But lurking behind that is an equally serious concern: nobody knows what this stuff actually costs to run at scale.

What Leading Organizations Are Doing

The companies getting ahead of this aren't waiting for the market to mature. They're treating agent economics as a first-class architectural concern right now.

Here's what that looks like in practice:

Token budgets per task type. Instead of letting agents run unlimited reasoning loops, smart teams are setting hard caps. A customer service query gets 4,000 tokens max. A complex research task gets 20,000. If the agent can't complete within budget, it escalates to a human rather than burning through your margin.

Tiered model selection. Not every task needs GPT-4 or Claude Opus. Leading teams are routing simple queries to smaller, cheaper models and reserving the heavy hitters for tasks that actually require them. One e-commerce company cut their agent costs by 60% just by using a smaller model for order status checks.

Caching aggressively. If your agent answers the same question twice, you're paying twice. Smart architectures cache common responses, embeddings, and intermediate reasoning steps. The upfront engineering investment pays for itself within weeks.

Real-time cost attribution. You need to know which workflows, which customers, and which agent behaviors are driving costs. This isn't a nice-to-have anymore. It's essential for understanding whether your AI investment is actually profitable.

The SMB Advantage

Here's the counterintuitive part: small and mid-sized businesses might actually be better positioned here than enterprises.

Large companies have legacy systems, procurement cycles, and committees that make it hard to pivot quickly. They're often locked into consumption-based contracts with AI vendors where costs scale unpredictably.

SMBs can choose differently from the start.

Fixed licensing models. Some AI platforms now offer predictable monthly pricing rather than pay-per-token chaos. You know exactly what you're spending before the month begins.

BYOA (Bring Your Own API). Instead of paying a markup on API costs, some services let you plug in your own API keys. You maintain a direct relationship with model providers and can optimize at the source.

Right-sized deployments. SMBs don't need enterprise-scale agent armies. Starting with one or two well-optimized AI employees, then scaling based on actual ROI, beats deploying twenty agents and hoping the math works out.

The FinOps Parallel Is Real

The cloud cost optimization industry is now worth billions. Entire companies exist just to help other companies understand their AWS bills. Careers have been built on making infrastructure spending visible and controllable.

Agent economics will follow the same trajectory. We're already seeing:

- Startups building agent cost monitoring tools

- Cloud providers adding AI spend tracking to their dashboards

- Best practices emerging around prompt optimization and model selection

- New licensing models designed for predictability

The companies that figure this out early will have a structural advantage. They'll be able to deploy agents profitably while competitors are still trying to understand why their AI budget exploded.

Three Things to Do This Week

If you're running AI agents in production (or planning to), here's where to start:

- Audit your current spend. Most organizations have no idea what they're actually paying per completed task. Break it down. You might be surprised which workflows are expensive and which are cheap.

- Set token budgets. Pick your top three agent use cases and define maximum token limits for each. Start conservative. You can always increase later.

- Evaluate your pricing model. If you're on consumption-based pricing with no ceiling, consider alternatives. Fixed licensing and BYOA models exist specifically to solve this problem.

Agent cost optimization isn't glamorous work. Neither was cloud cost optimization in 2019. But the companies that invested in FinOps early saved millions. The same opportunity exists right now for AI.

The question isn't whether agent economics will become a discipline. It's whether you'll be ahead of the curve or scrambling to catch up.

Want to test AI employees with predictable pricing? Geta.Team offers fixed licensing and BYOA models so you always know what you're spending. Try it here: https://geta.team